Introduction Copy Location

Copy Location

Interactive Brokers is merging our web-based API products into a single, comprehensive IBKR Web API, bringing the features of the Client Portal Web API, Digital Account Management, and the Flex Web Service together in a unified interface, accessible by a shared means of authorization and authentication: OAuth 2.0.

Existing endpoints and authentication schemes are not deprecated and will continue to receive features and updates. Rather, we look forward to providing our clients with a new, coordinated set of endpoints exposing the same backend resources. To support this orchestration, the documentation below addresses the functionality of the Client Portal Web API, Digital Account Management, and the Flex Web Service side by side under the Web API umbrella.

We organize this unified Web API and its documentation into two broad feature sets:

-

Account Management: This feature set delivers the functionality of our legacy Digital Account Management and Flex Web Services APIs, including new account creation, funding, and report generation.

-

Trading: This feature set encompasses the functionality of our Client Portal Web API, including trading, retrieval of live market data, and portfolio monitoring.

Additionally, we have expanded our development resources into two areas:

-

Documentation: Long-form, workflow-oriented material located in this section.

-

Reference: Per-endpoint API definitions, presented in a Swagger interface generated from an underlying OpenAPI spec.

Getting Started Copy Location

Copy Location

Much of the Web API's Trading functionality is offered to our clients without any approval process, and the available features are determined primarily by the capabilities of a client's username and account(s).

However, many Account Management features are only suitable for clients with certain institutional account structures, and the specifics of their usage will vary according to many factors, such as the Interactive Brokers business entity that carries the client's account structure, or the type of accounts within that structure.

Consequently, the majority of the Web API's Account Management functionality is not immediately available for client use without a review and approval by Interactive Brokers. We encourage our institutional clients to contact their Sales Representative for an introduction to this process and the considerations involved.

Additionally, we continue to offer several other methods of authentication in addition to OAuth 2.0, which can be used to access the Web API's Trading features specifically. Some of these authentication methods also require their own approval process and are designed to serve particular product offerings and development objectives. Our API Integration team can assist with choosing the right authentication technology for your project.

Please find more detailed descriptions of how to get started with both the Account Management and Trading APIs in their respective documentation sections.

Feedback Copy Location

Copy Location

Have feedback on our Web API documentation or reference material?

Email us at API-Feedback@interactivebrokers.com.

We value your suggestions, ideas, and feedback in order to continuously improve our API solutions.

This is an automated feedback inbox and unfortunately, we will not be actively responding from this email. However, if you need a specific answer or additional support, please contact our API Support team or access our general support. Current or prospective institutional clients may also contact their sales representative.

View our Web API Trading documentation here.

IntroductionCopy Location

Copy Location

Interactive Brokers (IBKR) Account Management API is available for Registered Advisors and Introducing Brokers that would like to customize IBKR’s Registration System and Client Portal or control client experience.

Client Registration

Copy Location

Copy Location

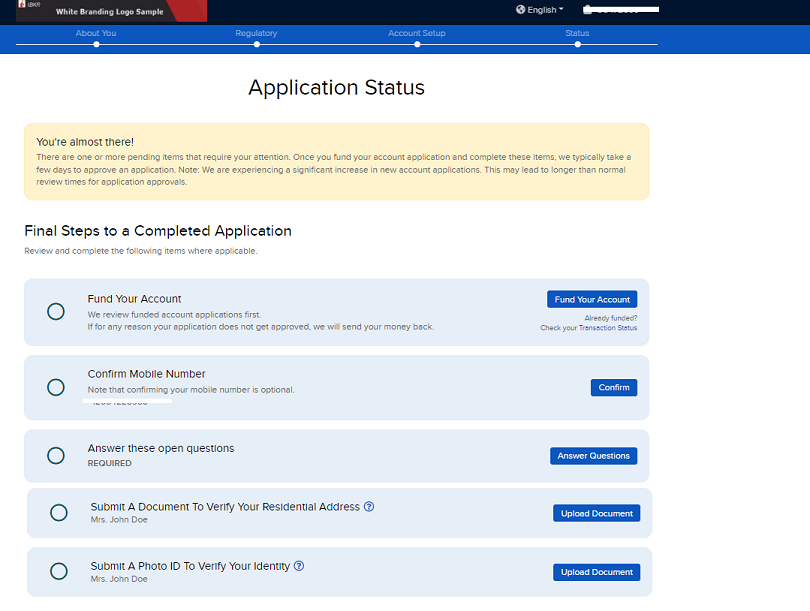

- Create New Account

- View Account Status

- View Registration Tasks

- Complete Registration Tasks

Account Maintenance

Copy Location

Copy Location

- Update Account Information

- Manage Account Settings

- Manage Trade Capabilities

- Fee Administration

Funds and Banking

Copy Location

Copy Location

- Cash Transfers

- Configure Recurring Transactions

- Manage Banking Instructions

- Position Transfers

- View Transactions

Reporting

Copy Location

Copy Location

- Generate Client Statement(s)

- Retrieve Tax Form

Authentication

Copy Location

Copy Location

- Connect user to IBKR white branded platform.

The Account Management API can be used in parallel or as a replacement to the IBKR Portal which is our out of the box solution available to registered advisors and introducing brokers free of cost.

Audience

Copy Location

Copy Location

Service is available by request only to advisors/brokers that are registered in a FATF Country. See Setup Process for instructions on how to get started.

Connectivity

Copy Location

Copy Location

IBKR’s Web API implementation follows standard HTTP verbs for communication. It employs a range of HTTP status codes and JSON-formatted messages to convey operation status and error information. To ensure secure communication, all API requests must use HTTPS. Authorization and Authentication for IBKR’s Web API is managed using OAuth 2.0.

Authentication

Copy Location

Copy Location

IBKR only supports private_key_jwt client authentication as described in RFC 7521 and RFC 7523.

- Client authenticates against the authorization server by presenting a signed JWT token called a client_assertion which the authorization server validates against the public key(s) provided by the client during registration.

- This scheme is considered safer than the standard client id/client secret authentication scheme used in early OAuth 2.0 integrations given that it prevents the client from having to pass the client secret in back-end requests.

Data Transmission

Copy Location

Copy Location

User requests will be sent to IBKR in JSON format using HTTPS.

[POST]and[PATCH]gw/api/v1/accounts, the payload includes archive (zip) file, encoded in base64.- All other

[POST]and[PATCH]requests, the payload will include JSON file that is encoded in base64.

System AvailabilityCopy Location

Copy Location

| Service Type | Downtime |

|---|---|

| Client Registration and Account Maintenance /gw/api/v1/accounts* |

Daily between 6pm ET-6:01pm ET. Wednesdays between 6pm ET to 6:30pm ET |

| Funds and Banking /gw/api/v1/bank-instructions* /gw/api/v1/client-instructions* /gw/api/v1/instruction* /gw/api/v1/external-asset-transfers* /gw/api/v1/external-cash-transfers* /gw/api/v1/internal* |

Daily between 11:45pm ET-12:30am ET Saturdays (any time), Sundays before 3PM ET |

System Status: https://www.interactivebrokers.com/en/software/systemStatus.php

Rate Limiting

Copy Location

Copy Location

For the Account Management Web API, Interactive Brokers currently enforces a global request rate limit of 10 requests per endpoint. If rate limit is exceeded, the API will return a 429 code.

SupportCopy Location

Copy Location

IBKR has a designated API team that is available for 24/5 support via email and will be primary point of contact during the integration process.

- Account Management API: dam@ibkr.com

- Trading API: api@ibkr.com

What We Provide

Copy Location

Copy Location

Figuring out where to begin start is the hardest part. To assist with getting started, we have created guides and API references which include everything you need to program your interface for Client Registration, Account Maintenance, Trading, and Portfolio Management. Your designated integration manager will be available for weekly calls throughout the integration process and up to 3 months after going live.

Resources

Copy Location

Copy Location

To help better understand the API endpoints, we suggest installing postman and install our postman collection. To receive a copy of the postman collection, contact dam@ibkr.com.

Setup ProcessCopy Location

Copy Location

IBKR’s account registration system and client portal are carefully engineered to meet our requirements; any request to outsource application workflow requires additional approval. We have summarized steps involved to use API for registration and funding in sequential order.

Preliminary

Copy Location

Copy Location

- Download and complete DAM Request Form.

- Send completed form to dam@ibkr.com with your IBKR account number.

- A representative from our API integration team will setup a 30-minute call to review the completed form.

- Team is available Monday-Friday between 3am EST to 5pm EST.

- After the preliminary call, IBKR will provide service agreement(s) needed to use API service(s).

- Return signed copy to dam@ibkr.com. IBKR API Integration Team will review request with IBKR Compliance.

- Approval process cannot be started until IBKR master account is opened.

- Approval process can take 3-5 business days.

- Return signed copy to dam@ibkr.com. IBKR API Integration Team will review request with IBKR Compliance.

Build and Test

Copy Location

Copy Location

IBKR will create QA instance reflective of your intended account structure which can be used to safely test our API solutions.

- To setup the QA (sandbox) environment, provide the following to dam@ibkr.com:

- RSA key (RSA-3072 or RSA-4096)

- IP Addresses (CIDR format)

- IBKR will share QA credential (Client ID).

- Build user interface which will be used to collect and manage client data.

- Test user interface

- Suggested test cases can be found here.

Go Live

Copy Location

Copy Location

- If all development work is complete and your team is ready to go live with the API integration, complete following:

- Provide IBKR with RSA Key for production using the IBKR message center.

- RSA key for production cannot be same as key that is used for QA

- Contact your API integration manager with the following:

- Web ticket number associated with RSA Key

- Summary of services which will be offered within platform

- Example: Hybrid registration, account deposits, single sign on for client portal, add trading permissions

- Instructions to access application interface in QA

- Screenshots of registration journey in sequential order (PDF)

- Signed Services Agreement (if this was not done during preliminary steps).

- Provide IBKR with RSA Key for production using the IBKR message center.

- IBKR will review and test interface.

- This process can take 3-5 business days

- During this period, IBKR can provide feedback on changes that are needed to go live.

- IBKR will send email with approval status of interface. If approved, IBKR will provide production credentials (Client ID) to your team using the IBKR message center.

- Test connectivity with the production credentials. If successful, provide following to your IBKR API integration manager:

- URL address to the application in the Production Environment.

- Contacts for Production (operations and maintenance).

- Launch to Production

Client RegistrationCopy Location

Copy Location

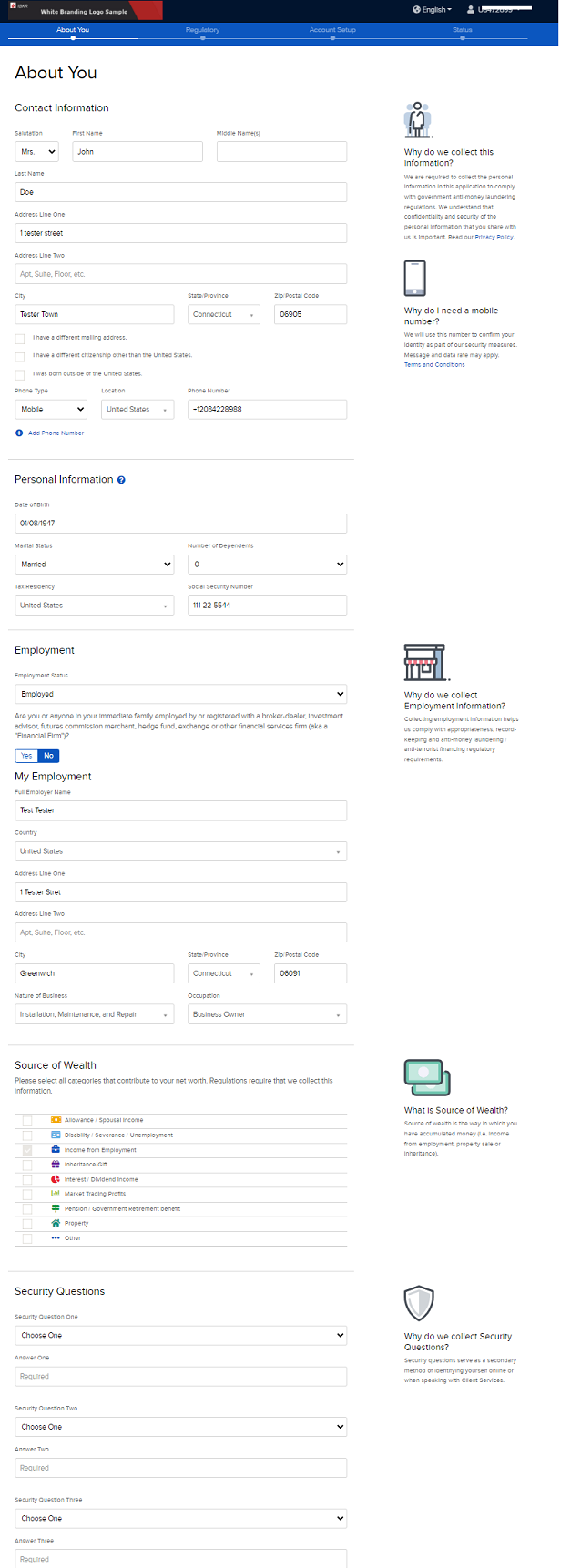

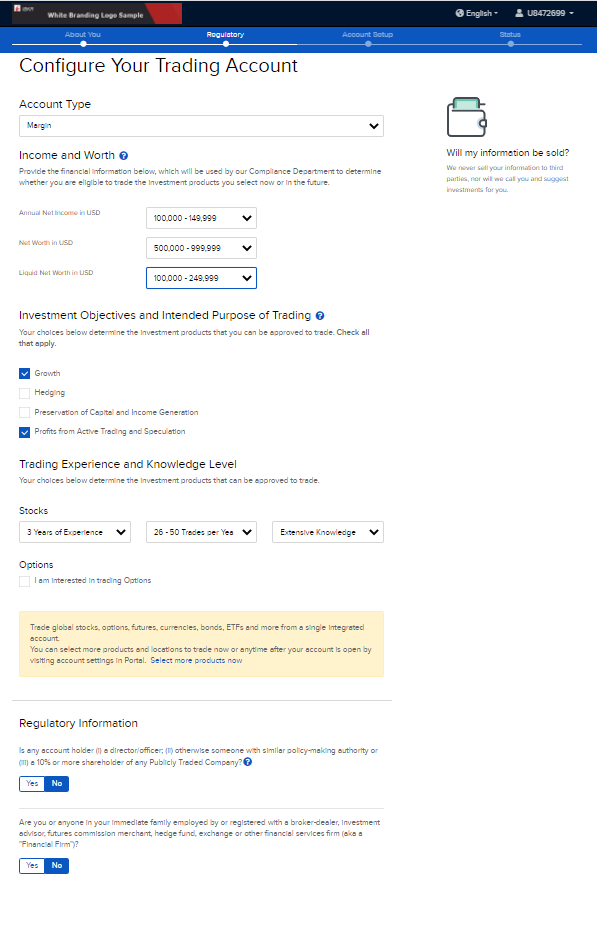

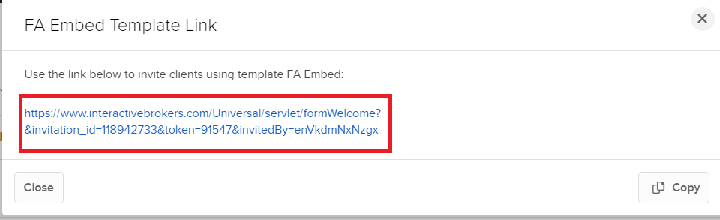

The accounts endpoint can be used to create a brokerage account with IBKR using the API. For client registration using the API, we offer two options:

- Full Integration: Hosting firm provides all data and forms required to create IBKR brokerage account via API.

- Hybrid: Submit partial application data to IBKR via API to create the account. User will enter remaining application data via the IBKR White Branded application. The application will be prefilled with data that was passed via the API.

- Connect user to IBKR White Branded Registration using Single Sign On. Alternatively, provide user with login URL to access IBKR Portal. Upon accessing IBKR Portal, user will be prompted to complete registration journey.

Available registration options at IBKR including IBKR hosted solutions can be found here.

Full Integration versus Hybrid

Copy Location

Copy Location

It is important to determine which option your team will use for client registration before starting the the technical integration. If you are just getting started or development team has limited capacity, we suggest using our Hybrid option and transition to Full Integration in later phase (if desired).

The table below includes the differences between Full Integration and Hybrid for client registration.

| Type | Full Integration | Hybrid |

|---|---|---|

| Hosting Firm | Counterparty | Counterparty & IBKR |

| Development Work | Yes | Minimal |

| Eligibility | Available to Registered Advisors and Introducing Brokers with approval from IBKR management | Available to Registered Advisors and Introducing Brokers. |

| Customization | Yes- design is managed by hosting firm. | Partial- IBKR platform will reflect your branding (Company name, logo, and color scheme). |

| Cost | Yes, the hosting firm is subject to an upfront and annual fee.

Pricing model takes into account the complexity of the integration and scope of services needed. |

Yes, the hosting firm [counterparty] is subject to an upfront and annual fee.

Pricing model takes into account the complexity of the integration and scope of services needed. |

| Supported Platforms | Determined by hosting firm. | Browser on desktop OR mobile device |

| Supported Customer Types | Individual Joint Retirement (U.S. and Canada) ISA (United Kingdom) SMSF (Australia) |

Individual Joint Retirement (U.S. and Canada) ISA (United Kingdom) SMSF (Australia) Organization (Corporation, LLC, Partnership) Trust |

| Minimum Data | All application data including documents (agreements, disclosures, and completed tax form) if applicable.

Table here for required data based on Account Type and Customer Type. |

Fully-Disclosed and Advisor Clients: IBKR minimally requires Name, Email, and Country of Residence to create an account. Non-Disclosed: All application data with exception of completed tax form is required. |

Data for Client RegistrationCopy Location

Copy Location

Required data to create client account via the API is dependent on the following factors:

- Customer Type

- FD= Fully-Disclosed Introducing Broker

- FA= Registered Investment Advisor

- OWD= One Way Disclosed Introducing Broker

- NonQI= Non-Disclosed Introducing Broker ; Non Qualified Intermediary

- QI with Trading= Non-Disclosed Introducing Broker; Qualified Intermediary where clients have access to trading

- QI with No Trading= Non-Disclosed Introducing Broker; Qualified Intermediary where clients do not have access to trading via IBKR system (eg. Trades will be placed via FIX).

- Registration Type

- Hybrid

- Full Integration

- Account Type

- Retail = Individual, Joint, Retirement, ISA

- Entity = SMSF, Trust, Organization

- IBKR Entity Driven by entity which master account is associated with. While accounts are accepted from citizens or residents of all countries except citizens or residents of those countries that are prohibited by the US Office of Foreign Assets Control, advisors/brokers may be limited from opening accounts for applicants that reside in the following countries:

- United States: Available to U.S. based IB-LLC brokers and advisors only.

- Canada: Available to IB-CAN brokers and advisors only.

- Hong Kong: Available to IB-HK brokers and advisors only.

- Australia: Available to IB-AU brokers and advisors only.

- Japan: Available to IBLLC brokers and advisors that are FSA Registered only.

- United Kingdom: Available to IB-UK brokers only.

- Singapore: Available to IB-SG brokers and advisors only.

- EEA: Available to IB-IE or IB-CE brokers and advisors only.

| Austria | Cyprus | Finland | Hungary | Lativa | Malta | Portugal | Spain |

| Belgium | Czech Republic | France | Iceland | Liechtenstein | Netherlands | Romania | Sweden |

| Bulgaria | Denmark | Germany | Ireland | Lithuania | Norway | Slovakia | |

| Croatia | Estonia | Greece | Italy | Luxembourg | Poland | Slovenia |

Expand each section to see specific field requirements by Customer Type.

| Object | FD | FA | OWD | NonQI | QI With Trading | QI No Trading |

|---|---|---|---|---|---|---|

| Account Holder(s) | ||||||

| email* | Y | Y | Y- email address of broker OR client is accepted. | Y- email address of broker OR client is accepted. | Y- email address of broker OR client is accepted. | Y- email address of broker OR client is accepted. |

| name* first, last |

Y | Y | Y | Y | Y | Y |

| dateOfBirth | Y | Y | Y | Y | Y | N |

| countryOfBirth | Y | Y | Y | Y | Y | N |

| numDependents | Y | Y | N | N | N | N |

| maritalStatus | Y | Y | N | N | N | N |

| identification ID Document, citizenship |

Y | Y | Y | Y | Y | N |

| mailingAddress country*, state, city, street1, postalCode |

Y | Y | Y | Y | Y | N |

| residenceAddress country*, state, city, street1, postalCode |

Y | Y | Y | Y | Y | Y- country only. |

| phones number, type- Mobile Required |

Y | Y | N | N | N | N |

| employmentType | Y | Y | Y | N | N | N |

| employmentDetails If EMPLOYED or SELFEMPLOYED: employer, occupation, employerBusiness, employerAddress |

Y | Y | Y | N | N | N |

| taxResidencies* country and tin |

Y | Y | Y | Y | N | N |

| Tax Form w8Ben, w9 |

Y | Y | Y | Y | N | N |

| withholdingStatement | N | N | N | N | Y | Y |

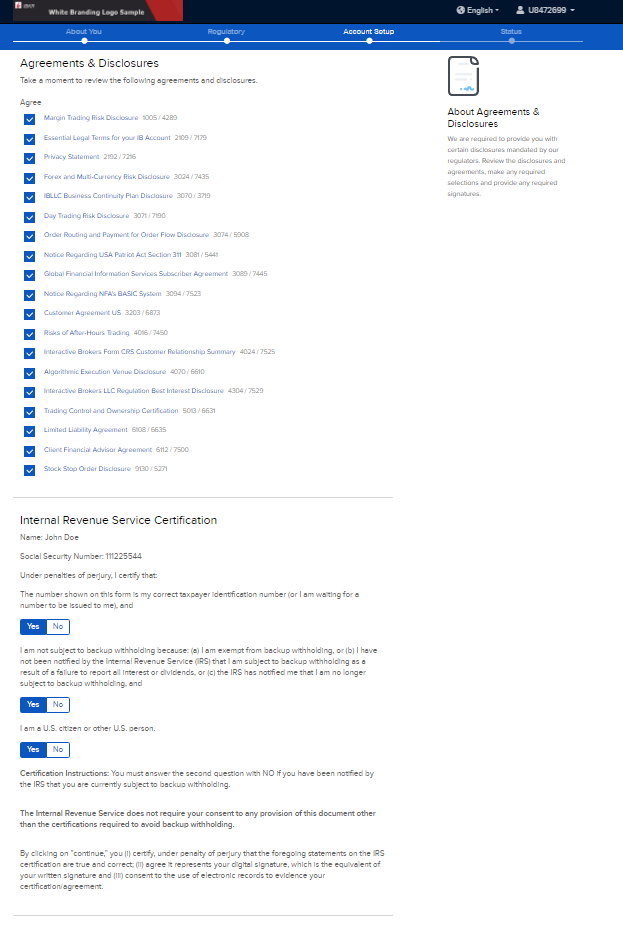

| IBKR Agreements and Disclosures | Y | Y | N | N | N | N |

| Proof of Address and Proof of ID Documents | Y (If Trulioo Verification is NoMatch) | Y (If Trulioo Verification is NoMatch) | Y (If Trulioo Verification is NoMatch) | Y (If Trulioo Verification is NoMatch) | Y (If Trulioo Verification is NoMatch) | N |

| Account Information | ||||||

| financialInformation netWorth, liquidNetWorth, annualNetIncome |

Y | Y | Y | N | N | N |

| sourcesOfWealth | Y | Y | Y | N | N | N |

| investmentExperience yearsTrading, tradesPerYear, knowledgeLevel | Y | Y | N | N | N | N |

| regulatoryInformation account holder or immediate family member a controller or employee of a publicly traded company or a registered rep | Y | Y | Y | N | N | N |

| accounts baseCurrency, margin |

Y | Y | Y | Y | Y | Y |

| tradingPermissions | Y | Y | Y | Y | Y | Y |

| investmentObjectives | Y | Y | N | N | N | N |

| advisorWrapFees | N | Y | N | N | N | N |

| IRA Beneficiaries | ||||||

| name first, last |

Y | N | – | – | – | – |

| dateOfBirth | Y | N | – | – | – | – |

| relationship | Y | N | – | – | – | – |

| ownership | Y | Y | – | – | – | – |

| identification citizenship |

Y | Y | – | – | – | – |

| mailingAddress country, state, city, street1, postalCode |

N | N | – | – | – | – |

| residenceAddress country*, state, city, street1, postalCode |

N | N | – | – | – | – |

| Object | FD | FA | OWD | NonQI | QI with Trading | QI No Trading |

Associated Persons |

||||||

| email* | Y | Y | Y- email address of broker OR client is accepted. | Y- email address of broker OR client is accepted. | Y- email address of broker OR client is accepted. | Y- email address of broker OR client is accepted. |

| name* first, last |

Y | Y | Y | Y | Y | Y |

| dateOfBirth | Y | Y | Y | Y | Y | N |

| countryOfBirth | Y | Y | Y | Y | Y | N |

| numDependents | Y | Y | N | N | N | N |

| maritalStatus | Y | Y | N | N | N | N |

| identification ID Document, citizenship |

Y | Y | Y | Y | Y | N |

| mailingAddress country*, state, city, street1, postalCode |

Y | Y | Y | Y | Y | N |

| residenceAddress country*, state, city, street1, postalCode |

Y | Y | Y | Y | Y | Y- country only. |

| phones number, type- Mobile Required |

Y | Y | N | N | N | N |

| employmentType | Y | Y | Y | N | N | N |

| employmentDetails (If EMPLOYED or SELFEMPLOYED) employer, occupation, employerBusiness, employerAddress |

Y | Y | Y | N | N | N |

| taxResidencies* country and tin |

Y | Y | Y | Y | N | N |

| taxForm w8Ben, w9 |

Y | Y | Y | Y | N | N |

| withholdingStatement | N | N | N | N | Y | Y |

| IBKR Agreements and Disclosures | Y | Y | N | N | N | N |

| Proof of Address and Proof of ID Documents | Y (If Trulioo Verification is NoMatch) | Y (If Trulioo Verification is NoMatch) | Y (If Trulioo Verification is NoMatch) | Y (If Trulioo Verification is NoMatch) | Y (If Trulioo Verification is NoMatch) | N |

Account Information |

||||||

| financialInformation netWorth, liquidNetWorth, annualNetIncome |

Y | Y | Y | N | N | N |

| sourcesOfWealth | Y | Y | Y | N | N | N |

| investmentExperience yearsTrading, tradesPerYear, knowledgeLevel | Y | Y | N | N | N | N |

| regulatoryInformation account holder or immediate family member a controller or employee of a publicly traded company or a registered rep | Y | Y | Y | N | N | N |

| accounts baseCurrency, margin |

Y | Y | Y | Y | Y | Y |

| tradingPermissions | Y | Y | Y | Y | Y | Y |

| investmentObjectives | Y | Y | N | N | N | N |

| advisorWrapFees | N | Y | N | N | N | N |

Entity Information |

||||||

| name first, last |

Y | N | – | – | – | – |

| dateOfBirth | Y | N | – | – | – | – |

| relationship | Y | N | – | – | – | – |

| ownership | Y | Y | – | – | – | – |

| identification citizenship |

Y | Y | – | – | – | – |

| mailingAddress country, state, city, street1, postalCode |

N | N | – | – | – | – |

| residenceAddress country*, state, city, street1, postalCode |

N | N | – | – | – | – |

*Required for Hybrid; else optional. If provided for Hybrid, data will be prefilled.

KYC DocumentsCopy Location

Copy Location

Identity and Address Verification

Copy Location

Copy Location

Real-time Trulioo verification is processed upon account creation for select countries. If Trulioo is verification is not successful, OR Trulioo verification is not supported or the country which the applicant resides in, Identity and Address verification is required for approval.

Trulioo is supported for applicants that reside in following countries

| Argentina | China | Malaysia | Russian Federation | Turkey |

| Australia | Denmark | Mexico | Singapore | United Kingdom |

| Austria | France | Netherlands | South Africa | United States |

| Belgium | Germany | New Zealand | Spain | |

| Brazil | Ireland | Norway | Sweden | |

| Canada | Italy | Portugal | Switzerland |

Other countries

- Identity and Address verification will always be required for approval.

Options for Identity and Address Verification

Option 1: Traditional Verification

Collect Proof of ID and Proof of Address documents from the client and submit documents to IBKR documentSubmission.

Processing Time: IBKR has a ‘follow the sun’ model with operators located globally and constantly reviewing and processing supporting documents for new applications. Documents typically processed within 24 hours. Meaning, accounts are approved/opened within 24 hours of the supporting documents being accepted by IBKR.

- Causes for delays could be unsupported doc type is submitted or image received is blurry/too dark

Registration Tasks

- 8001: Proof of Identity (POI)

- 8002: Proof of Address (POA)

Important to note: For IB-HK Non-Disclosed (QI and NonQI) clients, we only require Proof of Identity (8001).

- Important to note: For IB-HK Non-Disclosed (QI and NonQI) clients, we only require Proof of Identity (8001).

Option 2: Instant Verification

Opt to allow clients to verify using Au10tix (third-party application used to verify client’s identity /geo location).

- If Trulioo is NoMatch, IBKR will pass unique URL which can be used to connect user to Au10Tix to complete verification. The URL is valid for 24 hours. If more than 24 hours, a new URL will need to be generated using

/api/v1/accounts/{{accountId}}/kycendpoint.

Workflow:

- Embed Au10Tix URL or provide a QR code with Au10Tix URL within application.

- User accesses Au10Tix URL and will be prompted to complete consent message verifying they are OK for Au10Tix to capture Biometric information.

- If user consents, they will be prompted to take photos of the front and back of their ID’s and take a selfie.

- Au10Tix will process information and complete ID verification.

- If Au10Tix verification fails; user will be required to complete ‘Traditional Verification) and Provide a Proof of Address and Proof of Identity Document.

- If user declines consent, they will be prompted to complete Traditional Verification

Processing Time: Real-Time verification is completed- if Au10Tix verification passes; account will be approved/opened (Real-Time).

Registration Tasks:

- 8137: Au10Tix Identity and Address Verification

- 8437: Au10Tix Identity

Account StatusesCopy Location

Copy Location

The status of an account can be one of the following:

| Status | Description |

|---|---|

| A | Abandoned; deleted application. Only pending or new applications can be abandoned. An account can be abandoned due to inactivity (after 135 days) OR if Broker OR client initiates request to abandon the application. |

| N | Pending application and no funding details have been provided. |

| O | Open; Account has been approved and opened by IBKR. This is considered an active account. |

| C | Closed; Account that was once active OR opened accounts that were and then closed. |

| P | Pending application and funding instructions have been provided. |

| R | Rejected; account was never approved/opened- rejected by Compliance) |

| E | Reopen request is pending. |

| Q | Bulk migration account that is not yet approved by IBKR. |

The status can change from:

| N > P | N > R | P > R | A > P | O > C | E > O |

| N > O | N > A | P > A | A > O | C > O | Q > R |

| N > P | P > O | A > N | A > R | C > E | Q > O |

Close Account

Copy Location

Copy Location

The /gw/api/v1/accounts/close can be used to close an opened account based on the accountId. Requests are processed between 8am EST to 11am EST. Requests received outside of these hours will be processed the following day.

- Accounts eligible to be closed must have current status of O or Q.

- If status Q account is closed, status will move to R (rejected)

If an account is funded at the time of the closure request, withdrawalInfo with bankInstructionName and bankInstructionMethod will need to be set. IBKR will send excess funds to this instruction once the account is closed.

POST /gw/api/v1/accounts/close

{

"instructionType": "account_close",

"instruction": {

"clientInstructionId": "1012983",

"accountId": "U46377",

"closeReason": "not required",

"withdrawalInfo": {

"bankInstructionName": "test instruction",

"bankInstructionMethod": "WIRE"

}

}

}Cancel Application

Copy Location

Copy Location

The abandonAccount can be used to delete/cancel a pending application based on the accountId. Once the request is processed, the account will no longer appear in IBKR’s CRM as a PENDING account.

- Accounts eligible to be abandoned must have current status of P or N.

PATCH /gw/api/v1/accounts

{

"accountManagementRequests": {

"abandonAccount" : [

{

"referenceAccountId" : "U12345"

}

]

}

}Reset Application

Copy Location

Copy Location

The resetAbandonedAccount can be used to reset application that was previously marked abandoned based on the accountId. Accounts eligible to be reset must have current status of A and be less than 6 months old. Once the account has been reset, user can proceed with registration process.

PATCH /gw/api/v1/accounts

{

"accountManagementRequests": {

"resetAbandonedAccount" : [

{

"referenceAccountId" : "U12345"

}

]

}

}View Status by Account

Copy Location

Copy Location

The /gw/api/v1/accounts/{accountId}/status can be used to query the status by account. In addition to the status of the account, the response will include the following information:

| Attribute | Description |

|---|---|

| dateOpened | Date and time which the account was approved and opened at IBKR. If value is null- this means the account has not been opened yet. |

| dateStarted | Date and time which the account was created with IBKR. |

| dateClosed | Date and time which the account was closed with IBKR. |

| accountId | IBKR account ID. |

| status | Status of the IBKR account. |

| description | Description of the status. A= Abandoned N= New Account O= Open C= Closed P= Pending R= Rejected |

| masterAccountId | IBKR account ID which is associated with the advisor/broker which accountId is linked to. |

| state | State of the application; only present if status is N (New Account) OR P (Pending). Incomplete Application = Client Action Needed, use /gw/api/v1/accounts/{accountId}/tasks?type=pending to view pending registration tasksDocuments Required = Client Action Needed, use /gw/api/v1/accounts/{accountId}/tasks?type=pending to view documents required for approval.Under Review with IBKR = Application is PENDING on IBKR, no action needed. Pending Approval = Account is in the approval queue and should be opened by the following business day. |

View Status for Group of Accounts

Copy Location

Copy Location

The /gw/api/v1/accounts/status can be used to filter custom group of accounts associated with masterAccountId based on the following criteria:

| Name | Value | Description |

|---|---|---|

| startDate | yyyy-mm-dd | Required if querying list of accounts created within certain time period. |

| endDate | yyyy-mm-dd | Filter by date when account was created. If start date is provided, end date is mandatory |

| status | A N O C P R Q E |

Required if querying list of accounts that are certain status. |

Queries returning more than 10,000 results will trigger a timeout error, Implement pagination using ‘limit‘ and ‘offset‘ parameter to manage large result sets.

Registration TasksCopy Location

Copy Location

Registration tasks represent tasks required to activate or maintain a brokerage account at IBKR.

- Tasks include steps in the application sequence, client agreements and disclosures, tax form, supporting documents for approval, and additional verification tasks (Enhanced Due Diligence).

- Tasks can be used to track the lifecycle of an account and identify if client action is required to proceed with approval process.

The following attributes will be returned when viewing registration tasks associated with an account:

| Attribute | Description |

|---|---|

| formNumber | 4 digit number which IBKR associates with the registration task. |

| formName | Name of the form. The formNumber and formName will always be 1:1 mapping. |

| onlineTask | True= IBKR form that needs to be completed/Signed by the client. False= External document that needs to be sent to IBKR by the client. |

| requiredForTrading | True= Applicant will not be able to place trades until the online task is completed. False = Applicant can place trades prior to the task being completed. |

| requiredForApproval | True= Account will not be approved/opened until the task has been satisfied. False= Task is not required for approval. |

| action | Describes action associated with the task. to be sent= External Document that needs to be sent by the client to IBKR. to complete= IBKR form that needs to be completed by the account holder. to sign= IBKR form that needs to be signed by the client. |

| state | Current state of the task. To Be Sent: External document which needs to be submitted to IBKR. To Be Signed: IBKR agreement/disclosure which needs to be signed by the client. To Be Submitted: IBKR generated document which needs to be submitted to IBKR. To Be Completed: Online task which needs to be completed. Received- Being Processed: Document is being reviewed by IBKR. Rejected .. <Rejection Reason>: External document was rejected by IBKR. Submit new document that meets IBKR’s requirements to proceed with approval process. |

View Registration TasksCopy Location

Copy Location

IBKR will include the status of registration tasks in response file that is returned when creating an account via the API.

documents: Represents tasks that were included and processed when creating account via the API.

pendingTasks: Represents tasks that are required for account approval. Hosting firm is responsible for communicating pending tasks required for approval to the end user.

The gw/api/v1/accounts/{accountId}/tasks can be used to view registration tasks which are associated with an account after an account has been created.

IBKR segregates tasks into two types:

type=pending: View pending (incomplete) registration tasks which are required for account approval.

- If a registration task is assigned to a pending account and the task is not required for account approval, the task will not be returned in response.

- If registration task is assigned to an opened account and the task is required for an account upgrade, the task will not be returned in response.

type=registration :View all tasks associated with an account irrespective of the account status or state of the registration task.

- View date/time which user completed specific registration task.

- View registration tasks which the client needs to complete in order to trade or maintain account with IBKR.

Complete Registration TasksCopy Location

Copy Location

The [PATCH]/api/v1/accounts/ can be used to complete registration tasks for an existing account.

Service can be used to submit the following:

- IBKR agreements/disclosures

- KYC Documents including Proof of Identity, Proof of Address and Proof of Source of Wealth.

- Only single document accepted per formNumber, if document has multiple sides or pages, consolidate into single file prior to submitting to IBKR.

| Name | Type | Usage based on form_no | Description |

|---|---|---|---|

| referenceAccountId | String | All | IBKR account ID of the advisor/broker client account documents are being submitted for. |

| fileName | String | All | File name of the PDF document submitted to IBKR. fileName included within the documents request must match the fileName of the PDF file that is included within the signed request. Acceptable formats: .jpeg, .jpg, .pdf, .png Max size: 10 MB |

| sha1Checksum | String | All | SHA-1 is crypto algorithm that is used to verify that a file has been unaltered. This is done by producing a checksum before the file has been transmitted, and then again once it reaches its destination. |

| formNumber | String | All | Use /gw/api/v1/accounts/{accountId}/tasks to view a list of forms that are required for approval. |

| execTimestamp | YYYYMMDDHHMMSS | All | Timestamp of the execution of the agreement by the customer (i.e. time the client signed the agreement). |

| execLoginTimestamp | YYYYMMDDHHMMSS | All | Login timestamp for the session (when the client logged in and acknowledged the agreement. |

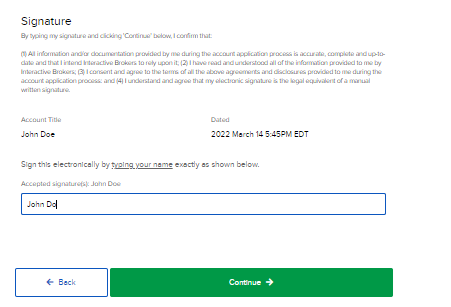

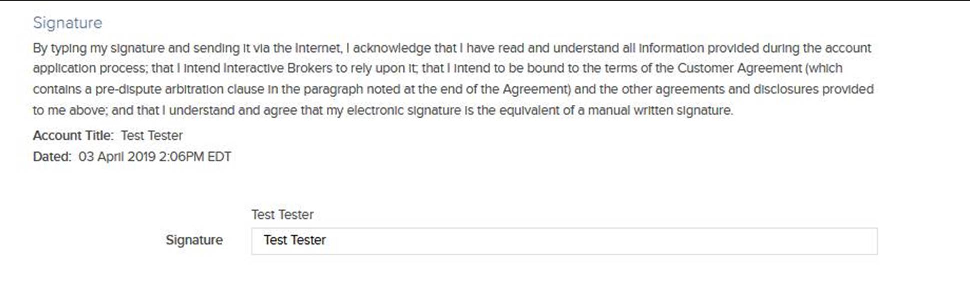

| signedBy | String | All | signedBy must match the submitted: name (first + middle initial (if applicable) + last).*Data is case and space sensitive. |

| proofOfIdentityType | All Entities Except for IB-CAN Driver License Passport Alien ID Card National ID Card IB-CAN only Bank Statement Evidence of Ownership of Property Credit Card Statement Utility Bill Brokerage Statement T4 Statement CRA Assessment |

8001 8205 8053 8057 |

Description of document submitted to salsify proof of identity. |

| proofOfAddressType | Bank Statement Brokerage Statement Homeowner Insurance Policy Bill Homeowner Insurance Policy Document Renter Insurance Policy bill Renter Insurance Policy Document Security System Bill Government Issued Letters Utility Bill Current Lease Evidence of Ownership of PropertyDriver LicenseOther Document |

8002 8001 8205 8053 8057 |

Description of document submitted to salsify proof of address. |

| validAddress | true false |

8001 | If Driver License is provided as proofOfIdentityType AND validAddress=true, single document can be used to satisfy Proof of Identity and Proof of Address. ] |

| documentType | Check Company Ownership Divorce Settlement Employer Confirmation Entitlement to Payments Letter Ownership Pay Slip Proof of Sale Proof of Winnings Severance Tax Return Will Bank Statement Brokerage Statement Current Lease |

8541 8542 8543 8544 8545 8546 8547 8548 8549 |

Acceptable documents will vary based on the formNo. |

| externalIndividualId | String | Identifier at the external entity for the individual executing the agreement. Must be an individual listed on the application. Ignored for INDIVIDUAL applications as agreements must be executed by the Account Holder. Required for JOINT accounts created via ECA for POI/POA submission. For the JOINT holder created via ECA, external id of the account holder needs to be provided for which POI/POA is being submitted. | |

| expirationDate | YYYY-MM-DD | Drivers License OR Passport | Provide expiration date of the ID document. |

- Acceptable formats: .jpeg, .jpg, .pdf, .png

- Max upload size: 25 MB

Acceptable documentType based on formNumber

Copy Location

Copy Location

| formName | formNumber | documentType |

|---|---|---|

| Proof of Identity and Date of Birth | 8001 | Driver License Passport Alien ID Card National ID Card |

| Proof of Address | 8002 | Bank Statement Brokerage Statement Homeowner Insurance Policy Bill Homeowner Insurance Policy Document Renter Insurance Policy bill Renter Insurance Policy Document Security System Bill Government Issued Letters Utility Bill Current Lease Evidence of Ownership of Property Driver License Other Document |

| Selfie Verification | 8205 | The account holder will need to take a ‘selfie’ holding their Identity document.For ID Document we only accept National ID OR Passport.Driver’s License/Alien card is not accepted. |

| Hong Kong Signature Verification | 8043 | Form8043.pdf |

| PROOF OF SOW-IND-Allowance | 8541 | Bank Statement Pay Slip Employer Confirmation Divorce Settlement Company Ownership |

| PROOF OF SOW-IND-Disability | 8542 | Bank Statement Entitlement to Payments Severance |

| PROOF OF SOW-IND-Income | 8543 | Pay Slip Bank Statement Employer Confirmation |

| PROOF OF SOW-IND-Inheritance | 8544 | Letter Bank Statement Check Will Brokerage Statement |

| PROOF OF SOW-IND-Interest | 8545 | Brokerage Statement Tax Return |

| PROOF OF SOW-IND-MarketProfit | 8546 | Ownership Brokerage Statement Tax Return |

| PROOF OF SOW-IND-Other | 8547 | Proof of Winnings Bank Statement Tax Return Brokerage Statement |

| PROOF OF SOW-IND-Pension | 8548 | Bank Statement Pay Slip |

| PROOF OF SOW-IND-Property | 8549 | Proof of Sale Current Lease |

PATCH /api/v1/accounts/

{"accountManagementRequests": { "documentSubmission": [

{

"documents": [

{

"signedBy": [

"Jane Doe"

],

"attachedFile": {

"fileName": "ProofOfId.pdf",

"fileLength": 9508,

"sha1Checksum": "b6e3235d3d21dc999da2fa24c7009ad0815e7330"

},

"formNumber": 8001,

"validAddress": true,

"execLoginTimestamp": 20210929123113,

"execTimestamp": 20210929123113,

"proofOfIdentityType": "Drivers License"

}

],

"referenceAccountId":"U123456,

"inputLanguage": "en",

"translation": false

}

]

}Service supports following questionnaires

- Due Diligence (EDD)

- Knowledge Assessment

The /api/v1/enumerations/edd-avt?form-number=<formNumber> can be used to retrieve list of questions associated questionnaire based on the formNumber.

| Name | Type | Description |

|---|---|---|

| referenceAccountId | String | IBKR account ID of the advisor/broker client account documents are being requested for. |

| formNumber | String | Form number associated with the Questionnaire. |

| detail | String | Maximum of 350 Characters. |

- If

citizenship, citizenship2, citizenship3orcountryOfBirthis prohibited country thenprohibitedCountryQuestionnaire(formNumber3442) will be assigned to the account. - List of Prohibited Countries can be obtained using

/api/v1/enumerations/prohibited-countryendpoint.

| Name | Type | Description |

|---|---|---|

| referenceAccountId | String | IBKR account ID of the client account which prohibitedCountryQuestionnaire is being submitted for. |

| code | PASSPORT CITIZENSHIP BUSINESSDEALINGS FINANCIALACCOUNTS RESIDENT MULTI BIRTH |

PASSPORT: Do you currently hold a passport from a Prohibited Country?

CITIZENSHIP: Do you currently hold a citizenship from a Prohibited Country? BUSINESSDEALINGS: Do you currently have business dealings in a Prohibited Country? FINANCIALACCOUNTS: Do you currently have financial accounts in a Prohibited Country? RESIDENT: Do you currently have plans to reside in a Prohibited Country? MULTI: Do you hold citizenship and/or residency status in multiple countries BIRTH: Were you born in any of the following countries <Prohibited Country> |

| externalId | String | externalID associated with the account holder. This should be the same externalID that was included in the request to create the account. |

| status | true false |

|

| details | string | Required if status=”true”; provide a description. |

Account InformationCopy Location

Copy Location

The /api/v1/accounts/{{accountId}}/details can be used to view account information based on the accountId.

The endpoint returns same data that is returned in IBKR’s end of day Acct_Status including:

- Profile Information (Name, Address, Contact Information, Employment Information)

- Fee Configuration

- Trading Capabilities (requested, approved, activated)

- Application Information (Date Started, Date Approved, Date Opened, Status, Date Funded)

- Account Configuration (Base Currency, Permissions, Special Programs)

- Market Data Subscriptions

- Financial Information (Net Worth, Income, Sources of Wealth)

- Risk Score

- Last Login

- User (Username, Last Login, Two Factor Authentication)

Update InformationCopy Location

Copy Location

The [PATCH]/api/v1/accounts/ can be used to manage user-level and account-level settings.

- Changes applied at the user level will be applied to all accounts associated with the user.

- Updates are only supported for accounts that are opened.

- Alternatively, information changes can be initiated within the IBKR Portal.

User

Copy Location

Copy Location

- Within the body of the request, provide updated information for the individual. If the information included within the

newAccountHolderDetailsnode does not match with what IBKR has on file, the information will be updated.- If multiple requests are submitted for single account; the new request will override the existing pending request.

- When submitting request to update account information, either

idORexternalIdwill be required.

- For Dual Language applications, details in both Native and Translated are required.

changeAccountHolderDetailsrequests are only supported for Individual AND Joint accounts that are open OR Pending/New application IF 9974 is assigned. If request is submitted for Pending/New application and 9974 is not assigned, the request will not be accepted.- If account information needs to be updated for a Pending/New account, a new application with the updated information will need to be submitted.

- To avoid duplicate accounts, please use

abandonAccountto delete the existing application with incorrect data. - When submitting a new application, a new unique external ID will need to be included. To submit a new application using the original external ID, (updateExternalId) for the existing account.

- Once updated, your team can resubmit the application for the applicant using the original external ID that was used to create the original account.

- New IBKR account ID will be generated once the application has been resubmitted.

- You cannot resubmit application for an external_id that had already been processed unless the externalId has been delinked (UpdateExternalId) from the original account.

- New IBKR account ID will be generated once the application has been resubmitted.

- To avoid duplicate accounts, please use

- If account information needs to be updated for a Pending/New account, a new application with the updated information will need to be submitted.

| Name | Type | Description |

|---|---|---|

| referenceAccountId | String | IBKR account ID associated with the individual. If user has multiple accounts and referenceAccountId, information will only be updated for the referenceAccountId. |

| referenceUserName | String | Username associated with the individual. If user has multiple accounts and referenceUserName is provided, data will be updated across all accounts. |

| inputLanguage | ||

| translation | ||

| id | String | The id is a unique id which IBKR assigns to each individual that is associated with account. The idcan be used as alternative to externalId. The idcan be obtained by calling GET /api/v1/accounts/{{accountId}}/details. |

| externalId | String | externalId associated with the individual. associated with the user. The externalId can be obtained from <Entities> section of response file for account creation. If there are multiple individuals on an account, each individual will have a unique externalId. |

| newAccountHolderDetails | Array of objects (AssociatedIndividual) | Provide applicant data to be updated within the newAccountHolderDetails. node. |

PATCH /gw/api/v1/accounts

{

"accountManagementRequests": {

"changeAccountHolderDetails": [

{

"newAccountHolderDetails": [

{

"id": "172032379"

{

"name": {

"salutation": "Ms.",

"first": "Jane",

"last": "Smith"

},

"referenceUserName": "joesm123",

"inputLanguage": "en",

"translation": false

}

]

}

}MIFIR data pertains to transaction reporting requirements for investment firms operating within European Economic Area (EEA) and the UK. As a client of an Investment Firm that uses the IBKR platform, you may be required to provide additional information to allow the proper transaction reports to be filed.

For more information refer to this link

| Name | Type | Description |

|---|---|---|

| referenceAccountId | String | IBKR account ID of the advisor/broker client account which request is being submitted for. |

| title | ACCOUNT HOLDER FIRST HOLDER SECOND HOLDER |

Individual Account Type title will always be “ACCOUNT HOLDER”

Joint Account Type. title will be one of: |

| identification | Identification | identification node included in XML request should match identification node that was included in Account Opening Request |

PATCH /gw/api/v1/accounts

{

"accountManagementRequests": {

"addMiFirData": [

{

"referenceAccountId": "U12345",

"title": "ACCOUNT_HOLDER",

"identifications": [

{

"citizenship": "Liechtenstein",

"passport": "A11111",

"alienCard": "AlienCard",

"expire": false

}

]

}

]

}

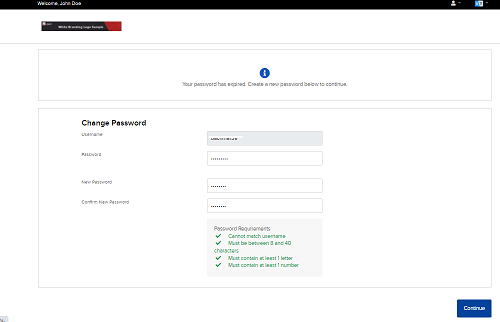

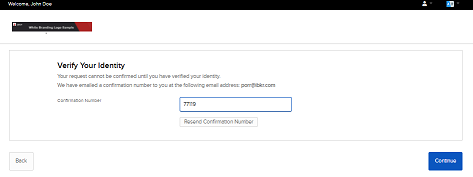

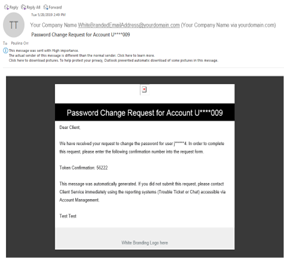

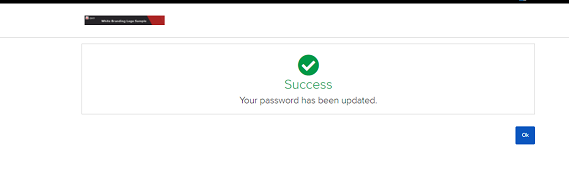

}Non-Disclosed Clients: Email address will be updated immediately.

Fully-Disclosed and Advisor: User will need to retrieve email confirmation token.

- Upon submitting request to update email, confirmation token for current email address

- IBKR will send confirmation token to users current email address.

- Counterparty instructs user to check email for confirmation token.

- Counterparty sends confirmation token to IBKR

- Confirmation token for new email address

- IBKR will send confirmation token to users new email address.

- Counterparty instructs user to check email for confirmation token.

- Counterparty sends confirmation token to IBKR

- Email address is updated successfully

| Name | Type | Description |

|---|---|---|

| referenceUserName | String | User name associated with the account. If you do not have the IBKR user name associated with the account, use /getAccountDetail to query user name based on account ID. |

| String | New email address | |

| hasAccess | true false |

Indicate if the user has access to the current email address. If the user does not have access to the current email address, the user cannot update the email address using DAM. |

| token | String | Confirmation token sent by IBKR to applicant via email. |

PATCH /gw/api/v1/accounts

"accountManagementRequests": {

"updateCredentials": [

{

"referenceUserName": "ctest9751",

"updateEmail": {

"email": "abqa@ibkr.com",

"token": "12345",

"access": true

}

}

]

}

}- Error will be triggered if any of the following conditions are met

- Request is submitted for ND-NonQI, FA, or FD sub account.

- Effective date is missing or is not the current date (ie. Future or Past Date).

| Name | Type | Description |

|---|---|---|

| referenceAccountId | String | IBKR account ID of the advisor/broker client account which request is being submitted for. |

| effectiveDate | YYYY-MM-DD | effectivedate of withholding statement. Current or future date. |

| certW8Imy | true false |

Confirm that consistent with the IRS, Form W-8IMY you provided, you certify you are qualified intermediary and have not assumed primary withholding responsibilities under Chapter 3 and 4 and have not assumed primary 1099 reporting and backup withholding responsibility on this account. You have assumed Form 1042 reporting to your customer This account is part of withholding statement for your Form W-8IMY. We wil request a W9 from those customers who you indicate are tax residents. |

| fatcaCompliantType | FATCA_COMPLIANT

NON_CONSENTING_US_ACCOUNT NON_COOPERATIVE_ACCOUNT |

Indicate if the Account Holder is FATCA compliant account |

| treatyCountry | 3 Digit ISO Code | If the account holder qualifies for treaty benefits under US income tax treaty, please identify treaty.

>N/A is acceptable if account holder does not qualify for treaty benefits. |

| usIncomeTax | true false |

Indicate if the owner of this account is a US Income Tax Resident. |

PATCH /gw/api/v1/accounts

{

"accountManagementRequests": {

"updateWithholdingStatements": [

{

"referenceAccountId": "U12345",

"treatyCountry": "CHN",

"fatcaCompliantType": "FATCA_COMPLIANT",

"effectiveDate": "2020-01-02",

"certW8Imy": true,

"usIncomeTax": true

}

]

}

}-

w8Ben: US Treasury and IRS require IBKR to request new tax identification form from non-US Persons every 3 years IF tax treaty country (part29ACountryinw8Ben) is set.- The account holder must provide IBKR with a new tax form (Form 5001).Electronic Signature and Requirements for form submission are the same as account opening.Re-certification of this form ensures that account holder will be treated as non-US person for tax purposes.Failure to provide updated tax form by expiration date will result in account being subject to US Tax withholding at 30% on interest, dividends, payments in lieu and royalty. In addition, 28% US Tax withholding will apply to all gross proceeds from sales.

If no tax treaty is set (

part29ACountry=”N/A”), thew8Bendoes not expire. - Certain

changeAccountHolderDetailsrequests require user to submit a new tax form reflecting the updated information. The tax form can be submitted via DAM API or via IBKR Hosted Portal.- Profile changes which require user to submit a new tax form:

name (first, last)citizenshipresidenceAddressmailingAddresstaxResidency country/gw/api/v1/accounts/{accountId}/login-messagescan be used to view login messages assigned to a specific account.

- Profile changes which require user to submit a new tax form:

| Name | Type | Description |

|---|---|---|

| referenceAccountId | String | IBKR account ID of the advisor/broker client account which request is being submitted for. |

| externalId | String | externalId associated with the individual. |

| entityId | String | Unique ID associated with the individual. ID can be obtained from <Entities> section of response file for create.

If there are multiple individuals on an account, each individual will have a unique id. |

| <TaxForm> | w8Ben (Non-US) localTaxForms OR w9 (US Clients) |

Enter new tax form details. Validations for this section mimic same validations that are applied when including tax form for client registration. |

| documents | Include document details associated with the tax form. Validations for this section mimic same validations that are applied when including tax form for client registration |

PATCH /gw/api/v1/accounts

{

"accountManagementRequests": {

"updateTaxForms": [

{

"referenceAccountId": "U12345", "entityId": "123456",

"externalId": "Test12346",

"documents": [

{

"formNumber": "5001",

"execTimestamp": "20161221123500",

"execLoginTimestamp": "20161221123500",

"signedBy": [

"John Doe"

],

"attachedFile": {

"fileName": "Form5001.pdf",

"fileLength": "67700",

"sha1Checksum": "D8AA699678D12DE6AC468A864D4FAE7999AA904B"

}

}

],

"w8Ben": {

"name": "John Doe",

"explanation": "TIN_NOT_REQUIRED",

"part29ACountry": "CAN",

"cert": true,

"blankForm": true,

"taxFormFile": "Form5001.pdf",

"proprietaryFormNumber": "5001"

}

}

]

}

}Account

Copy Location

Copy Location

Currently only LITE/PRO designation is supported. Requests submitted prior to 3pm EST are processed around 5pm EST. Requests submitted after 3pm EST are processed following business day at 5pm EST.

| Name | Type | Description |

|---|---|---|

| referenceAccountId | String | IBKR account ID of the advisor/broker client account which request is being submitted for. |

| value | true false |

true: Enable service false: Disable Service |

| type | LiteExecution | Configuration type |

PATCH /gw/api/v1/accounts

{

"accountManagementRequests": {

"accountConfiguration" : [

{

"referenceAccountId" : "U12345",

"type" : "LiteExecution",

"value" : "true"

}

]

}

}- Individual/Joint/IRA accounts with a net worth of at least $1,000,000 are identified as an Accredited Investor.

- Accredited Investors can update their investor category to Qualified Purchaser or Eligible Contract Participant within IBKR Portal IF their

netWorth> 5M USD or equivalent.

| Code | Usage | Description |

|---|---|---|

| referenceAccountId | String | IBKR account ID of the advisor/broker client account which the Investor Category is being changed for. |

| signedBy | String | Signature of the Account Holder. signedBy should be First Name + Middle Initial (If Applicable) + Last Name + Suffix (If Applicable). Data is case and case sensitive. |

| status | true false |

true= Yes Fales = No |

| accreditedInvestor | Required | The answers you provided in your account application indicate that you are qualified as an accredited Investor (as defined in Rule 501(a) of Regulation D of the Securities Act of 1933). |

| qualifiedPurchaser | Optional | qualifiedPurchaser: You may be qualified as a Qualified Purchaser (as defined in Section 2(a)(51) of the Investment Company Act of 1940), which would allow you to participate in certain special programs.

Would you like to answer a few questions so Interactive Brokers can determine if you may qualify as an ECP? YES/NO |

| investmentCompanyAct | Required if qualifiedPurchaser=true | Are you a natural person who owns at least $5,000,000 in investments (as defined in Rule 2a51-1 under the Investment Company Act of 1940)?YES/NO |

| discretionaryBasis | Required if qualifiedPurchaser=true | Are you a natural person who is acting for his own account or the accounts of other qualified purchasers and who in the aggregate owns and invests on a discretionaryBasis at least $25,000,000 in investments? YES/NO |

| eligibleContractParticipant | Optional | Eligible Contract Participant United States regulations impose restrictions on customers who are not Eligible Contract Participants (ECPs) (as defined in Section 1a(12) of the Commodity Exchange Act), which may limit your trading. Click here to learn more about the benefits of being an ECP.

The answers you provided in your account application indicate that you may qualify as an ECP. YES/NO |

| discretionaryBasis | Required if EligibleContractParticipant = True | Are you an individual, acting for your own account, who has more than $10,000,000 invested on a discretionary basis? YES/NO |

| highRisk | Required if discretionaryBasis= False | Are you an individual, acting for your own account, who has invested more than $5,000,000 on a discretionary basis and your transaction activity is intended to hedge the risk of other assets you have (or that you are reasonably likely to have)? YES/NO |

PATCH /gw/api/v1/accounts

{

"accountManagementRequests": {

"accreditedInvestors": [

{

"referenceAccountId": "U12345",

"status": true,

"signedBy": [

"Test Test"

],

"qualifiedPurchaser": {

"status": true,

"qualifiedPurchaserDetails": [

{

"code": "InvestmentCompanyAct",

"status": true

},

{

"code": "DiscretionaryBasis",

"status": true

}

]

},

"eligibleContractParticipant": {

"status": true,

"eligibleContractParticipantDetails": [

{

"code": "HighRisk",

"status": true

},

{

"code": "DiscretionaryBasis",

"status": false

}

]

}

}

]

}

}- Add CLP (Complex Leverage Product) capabilities to an existing account.

| Name | Type | Description |

|---|---|---|

| referenceAccountId | String | IBKR account ID of the advisor/broker client account which request is being submitted for. |

PATCH /gw/api/v1/accounts

{

"accountManagementRequests": {

"addCLPCapabilities" : [

{

"referenceAccountId" : "U12345"

}

]

}

}Validations for Fully-Disclosed and Advisor-Clients

Copy Location

Copy Location

- The account holder must be presented with the required form AND sign the required form before the counterparty submits the request to IBKR.

- 4155: Risk Disclosure for Complex or Leveraged Exch-Traded Products

- Eligibility is validated against users age, Investment Experience, and Financial Information.

- For Fully-Disclosed clients; the account holder must have a minimum of two years trading experience with stocks AND either options or futures.

Futures

- 1 year, 1-10 Trades per year

- This will not validate

- Because client has less than two years trading Futures, client must take Futures Exam

- 2 years, 1-10 Trades per year

- This will validate if Knowledge level is Good or Extensive

- Will not validate if Knowledge Level is Limited

Options

- 1 year, 1-10 Trades per year

- This will not validate

- Because client has less than two years trading Options, client must take Options Exam

- 2 years, 1-10 Trades per year

- This will validate if Knowledge level is Good or Extensive

- Will not validate if Knowledge Level is Limited

By default, all clients have access to currency conversion. Leveraged FX allows you to trade currency pairs with leverage. With leveraged FX, you are able to trade larger position sizes with a smaller amount of margin. Leveraged FX trading to eligible clients.

| Name | Type | Description |

|---|---|---|

| referenceAccountId | String | IBKR account ID of the advisor/broker client account which request is being submitted for. |

PATCH /gw/api/v1/accounts

{

"accountManagementRequests": {

"addLevFxCapabilities" : [

{

"referenceAccountId" : "U12345"

}

]

}

}Add trading permissions to an opened account.

Processing Time:

- New Regions: Trade Permissions for new regions are effective immediately

- New Products: New Products take 1-2 business day to be processed and reviewed by our compliance team.

| Name | Type | Description |

|---|---|---|

| addTradingPermissions | Array of Objects tradingPermissions | Trading permissions which are being requested. |

| referenceAccountId | String | IBKR account ID of the advisor/broker client account which request is being submitted for. |

PATCH /gw/api/v1/accounts

{

"accountManagementRequests": {

"addTradingPermissions": [

{

"tradingPermissions": [

{

"assetClass": "STK",

"exchangeGroup": "EU-IBET",

"country": "BELGIUM",

"product": "STOCKS"

}

],

"referenceAccountId": "U123456"

}

]

}

}PATCH /gw/api/v1/accounts

{

"accountManagementRequests": {

"addTradingPermissions": [

{

"tradingPermissions": [

{

"assetClass": "STK",

"exchangeGroup": "EU-IBET",

"country": "BELGIUM",

"product": "STOCKS"

}

],

"documentSubmission": {

"documents": [],

"referenceAccountId":"U123456",

"inputLanguage": "en",

"translation": false

},

"referenceAccountId":"U123456"

}

]

}

}Disclaimer: For Fully-Disclosed and Advisor-Clients

- If the exchange_group requires a form, the request to AddTradePermissions must be initiated by the client.

- The account holder must be presented with the required form AND sign the required form before the counterparty submits the request to IBKR.

- If the trading bundle does not require a form, you can submit to IBKR directly as the client does not need to sign a disclosure.

Update the base currency for an opened account. Base currency requests will not be effective until the following business day.

| Name | Type | Description |

|---|---|---|

| reference_account_id | String | IBKR account ID of the advisor/broker client account which request is being submitted for. |

| new_base_currency | Currency code (3 digits). Available currencies can be found here. | New base currency for the account. |

PATCH /gw/api/v1/accounts

{

"accountManagementRequests": {

"changeBaseCurrencies": [

{

"referenceAccountId": "U12345",

"newBaseCurrency": "USD"

}

]

}

}- Used to update and increase Investment Experience, Investment Objectives, and/or Financial Information for existing accounts. The service cannot be used to downgrade experience.

- Processing Time

- Fully-Disclosed and Advisor Clients: Takes 1-2 business day to be processed and reviewed by our compliance team.

| Name | Type | Description |

|---|---|---|

| referenceAccountId | String | IBKR account ID of the advisor/broker client account which request is being submitted for. |

| newFinancialInformation | Array of objects financialInformation investmentExperience investmentObjectives sourcesOfWealth |

Provide updated information. |

PATCH /gw/api/v1/accounts

{

"accountManagementRequests": {

"changeFinancialInformation": [

{

"referenceAccountId": "U12345",

"newFinancialInformation": {

"investmentExperience": [

{

"assetClass": "BILL",

"yearsTrading": 2,

"tradesPerYear": 5,

"knowledgeLevel": "Extensive"

}

],

"investmentObjectives": [

"Trading",

"Growth",

"Speculation",

"Hedging",

"Preservation",

"Income"

],

"additionalSourcesOfIncome": [

{

"sourceType": "CONSULTING",

"percentage": 4,

"description": "from Spouse"

},

{

"sourceType": "INHERITANCE",

"percentage": 10,

"description": "father property"

}

],

"sourcesOfWealth": [

{

"sourceType": "SOW-IND-Allowance",

"percentage": 25,

"usedForFunds": false,

"description": "Allowance from spouse"

},

{

"sourceType": "SOW-IND-Disability",

"percentage": 50,

"usedForFunds": false,

"description": "Allowance from spouse"

},

{

"sourceType": "SOW-IND-Inheritance",

"percentage": 23,

"usedForFunds": true,

"description": "Allowance from spouse"

}

],

"netWorth": 1700000,

"liquidNetWorth": 120000,

"annualNetIncome": 210000,

"totalAssets": 173000,

"sourceOfFunds": "string",

"translated": false

}

}

]

}

}Upgrade margin capabilities for an existing account.

- Cash accounts can upgrade to a Margin account.

- To upgrade to a Portfolio Margin account, you must be approved to trade options and your account must have at least USD 110,000 (or USD equivalent) in Net Liquidation Value.

- Processing Time

- Upgrade requests can take 1-2 business day to be processed and reviewed by our compliance team.

| Name | Type | Description |

|---|---|---|

| referenceAccountId | String | IBKR account ID of the advisor/broker client account which request is being submitted for. |

| newMargin | RegT REGT PortfolioMargin PORTFOLIOMARGIN |

Portfolio Margin: Risk Based Model and can offer anywhere from a 6:1 leverage for a diverse portfolio; and down to a 3:1 leverage for a more concentrated portfolio.

Minimum Equity: $100,000 If the account falls below $100,000 the account will be in close only mode. RegT: Rule based margin and offers 4:1 leverage intraday and 2:1 leverage overnight. Minimum Equity: $2,000 |

PATCH /gw/api/v1/accounts

{

"accountManagementRequests": {

"changeMarginTypes": ["referenceAccountId": "U12345",

"newMargin": "Margin"

}

]

}

}PATCH /gw/api/v1/accounts

{

"accountManagementRequests": {

"changeMarginTypes": [

{

"documentSubmission": {

"documents": [

{

"signedBy": [],

"validAddress": true,

"execTimestamp": 10,

"documentType": "Certified Proof of Address",

"expirationDate": "2033-11-22"

}

],

"referenceAccountId": "U12345",

"inputLanguage": "en",

"translation": false

},

"referenceAccountId": "U12345",

"newMargin": "xMargin"

}

]

}

}Disclaimer: For Fully-Disclosed and Advisor-Clients

- The account holder must be presented with the required form AND sign the required form before the counterparty submits the request to IBKR.

Dividend reinvestment (DRIP) is an option where you can elect how you wish to receive your dividends for stocks and mutual funds. Dividend Reinvestment is available to IB LLC, IB AU, IB CAN, IB HK, IB IE, IB JP, IB SG and IB UK clients only.

Information on DRIP can be found here.

| Name | Type | Description |

|---|---|---|

| referenceAccountId | String | IBKR account ID of the advisor/broker client account which request is being submitted for. |

PATCH /gw/api/v1/accounts

{

"accountManagementRequests":{

"enrollInDRIP":{

"referenceAccountId": "U12345",

}

}

}Disclaimer: For Fully-Disclosed and Advisor-Clients

- The account holder must be presented with the required form AND sign the required form before the counterparty submits the request to IBKR.

| Name | Type | Description |

|---|---|---|

| referenceAccountId | String | IBKR account ID of the advisor/broker client account which request is being submitted for. |

PATCH /gw/api/v1/accounts

{

"accountManagementRequests":{

"leaveDRIP":{

"referenceAccountId": "U12345",

}

}

}- Processing Time

- Requests submitted prior to 5pm EST will be processed same day.

- Requests submitted after 5pm EST will be processed the following business day.

| Name | Type | Description |

|---|---|---|

| referenceAccountId | String | IBKR account ID of the advisor/broker client account which request is being submitted for. |

PATCH /gw/api/v1/accounts

{

"accountManagementRequests":{

"leaveSYEP":{

"referenceAccountId": "U12345",

}

}

}- Processing Time

- Requests submitted prior to 5pm EST will be processed same day.

- Requests submitted after 5pm EST will be processed the following business day.

| Name | Type | Description |

|---|---|---|

| tradingPermission | Array of Objects tradingPermissions | Trading permissions to be removed. |

| referenceAccountId | String | IBKR account ID of the advisor/broker client account which request is being submitted for. |

PATCH /gw/api/v1/accounts

{

"accountManagementRequests": {

"removeTradingPermissions": [

{

"tradingPermissions": [

{

"assetClass": "STK",

"exchangeGroup": "AUS-OPT",

"country": "BELGIUM",

"product": "STOCKS"

}Account alias will appear on account statements, portal, and TWS.

- Processing Time: Changes will be effective immediately. You will need to restart TWS OR Portal to view the new alias.

| Name | Type | Description |

|---|---|---|

| referenceAccountId | String | IBKR account ID of the advisor/broker client account which request is being submitted for. |

| accountAlias | String Max # of characters: 80 |

Account alias or Nickname |

PATCH /gw/api/v1/accounts

{

"accountManagementRequests": {

"updateAccountAliases": [

{

"referenceAccountId": "U12345",

"accountAlias": "U111"

}

]

}

}| Name | Type | Description |

|---|---|---|

| referenceAccountId | String | IBKR account ID of the advisor/broker client account which request is being submitted for. |

| representativeId | String | IBKR username of the account representative. User must be listed on the master account which account is associated with. |

| percentage | Number | Total percentage across all representatives should add up to 100%. |

PATCH /gw/api/v1/accounts

{

"accountManagementRequests": {

"updateAccountRepresentatives": [

{

"referenceAccountId": "U12345",

"representativeDetails": [

{

"representativeId": "ajd0318a",

"percentage": 100

}

]

}

]

}

}SFC regulation requires clients under IBHK with trading permissions to SEHK stocks OR bonds to provide BCAN.

- Only applicable for Non Disclosed (QI and NonQI) – All Customer Types.

| Name | Type | Description |

|---|---|---|

| referenceAccountId | String | IBKR account ID of the advisor/broker client account which request is being submitted for. |

| bcan | String | Broker-to-Client-Assigned-Number (bcan). – It must be 10 digits or less without leading 0 and it cannot be 1-99. |

| ceNumber | String | Central entity number (CE#) of broker. It must be 6 digit alphanumeric identifier. |

PATCH /gw/api/v1/accounts

{

"accountManagementRequests": {

"updateBcan": [

{

"referenceAccountId": "U12345",

"bcan": "1125",

"ceNumber": "BNO808"

}

]

}

}Client FeesCopy Location

Copy Location

IBKR provides ability for advisors and brokers to charge fee for their services. Advisors/brokers can configure fees on an account by account basis OR manage fees using a client fee template. The API can be used to view and manage fee templates for existing accounts.

- Client fee templates make it easy to maintain client fee schedule for multiple accounts. Fee templates can be created and updated directly within Portal > Administration & Tools > Fees & Invoicing > Fee Templates.

View Fee Template for Account

Copy Location

Copy Location

The /gw/api/v1/fee-templates/query endpoint can be used to view fee template that is currently assigned by accountId. FEE_TEMPLATE_NOT_FOUND response will be returned IF no fee template is applied OR if fee configuration applied is not defined by template.

POST /gw/api/v1/fee-templates/query

{

"instructionType": "get_fee_template",

"instruction": {

"clientInstructionId": "1012983",

"accountId": "U46377"

}

}Set Fees for Account

Copy Location

Copy Location

The /gw/api/v1/fee-templates endpoint can be used to assign a predefined fee template to an existing account. Within the body of the request, define the accountId and the templateName. The templateName represents name of fee template to be applied, the data is case sensitive and must match exact name of template that exists in portal.

- For broker clients, fee changes submitted before 17:00 ET are processed on the same day and will take effect starting from midnight on the following business day.

- For advisor-clients, if the fee is increased or fee type is changed, the client will need to verify/acknowledge the fee increase directly in Account Management/Client Portal.

- Fee templates acknowledged by the client prior to 5:45PM ET will be processed on the same day.

- Fee templates acknowledged by the client after 5:45PM ET will be processed on the following business day.

- If the fee is decreased, the fee will be automatically processed (no client acknowledgement is needed).

POST /gw/api/v1/fee-templates

{

"instructionType": "apply_fee_tempate",

"instruction": {

"clientInstructionId": "1012983",

"accountId": "U46377",

"templateName": "Test template"

}

}Login MessagesCopy Location

Copy Location

If client action is required post account creation, IBKR will assign a login message to the user. Once login message is assigned, user will be prompted to complete login message upon accessing IBKR Portal.

Scenarios which IBKR will assign a login message:

- Expired tax form

- Update CRS form

- Verify Account Information

- Email Bounced

With exception of tax form updates, completion of login messages are only supported within IBKR Portal (not via API).

View Login Messages by Account

Copy Location

Copy Location

The /gw/api/v1/accounts/{accountId}/login-messages can be used to view login messages assigned to a specific account.

View Login Messages for Group of Accounts

Copy Location

Copy Location

/gw/api/v1/accounts/login-messages can be used to filter list of accounts with login messages assigned.

- Filter list of accounts with specific login message assigned.

- Filter list of accounts created within certain time range.

| Name | Value | Description |

|---|---|---|

| startDate | yyyy-mm-dd | Required if querying list of accounts created within certain time period. |

| endDate | yyyy-mm-dd | Filter by date when account was created. If start date is provided, end date is mandatory |

| messageType | W8INFO MIFIR_INFO |

W8INFO (Expired Tax Form) MIFIR_INFO (MIFIR Data Required) Optional- used to filter by Login Message Type |

Queries returning more than 10,000 results will trigger a timeout error, Implement pagination using ‘limit‘ and ‘offset‘ parameter to manage large result sets.

Funds and BankingCopy Location

Copy Location

When submitting a funding requests using the API, a clientInstructionId will be set within body of the request. The clientInstructionId is a unique identifier associated with the request which is set by the hosting firm; this value cannot be reused. IBKR’s preference is that the clientInstructionId is established in sequential order ie 1, 2, 3, 4 or 100, 101, 102, 103 not 777, 589, 123. The maximum value is 20 digits.

Status of Request

Copy Location

Copy Location

IBKR returns response within 30 seconds of funding request being submitted. The response will return one of the following status’

PROCESSED: Request has been processed.PENDING: Pending ProcessingREJECTED: IBKR unable to process the request.

The /gw/api/v1/client-instructions/{clientInstructionId} endpoint can be used to poll for status of previously uploaded funding request based on the clientInstructionId associated with the request.

Cancel Request

Copy Location

Copy Location